Sign Petition to End Illinois' Sanctuary State StatusSign my petition to protect Second Amendment RightsContact Rep. Halbrook

Sign up for email updates

Thanks for signing up!

By submitting your information, you agree to receive official emails from State Representative Brad Halbrook. You can opt out at any time.

Recent News

Tuesday, April 23, 2024

Illinois has a national reputation for corruption. If we want to turn that around and earn the trust of our residents, we have to end public corruption in Illinois. We…

Monday, April 22, 2024

Tonight, the 8-day celebration of Passover begins. Happy Passover to all who will begin this holy celebration!

Wednesday, April 17, 2024

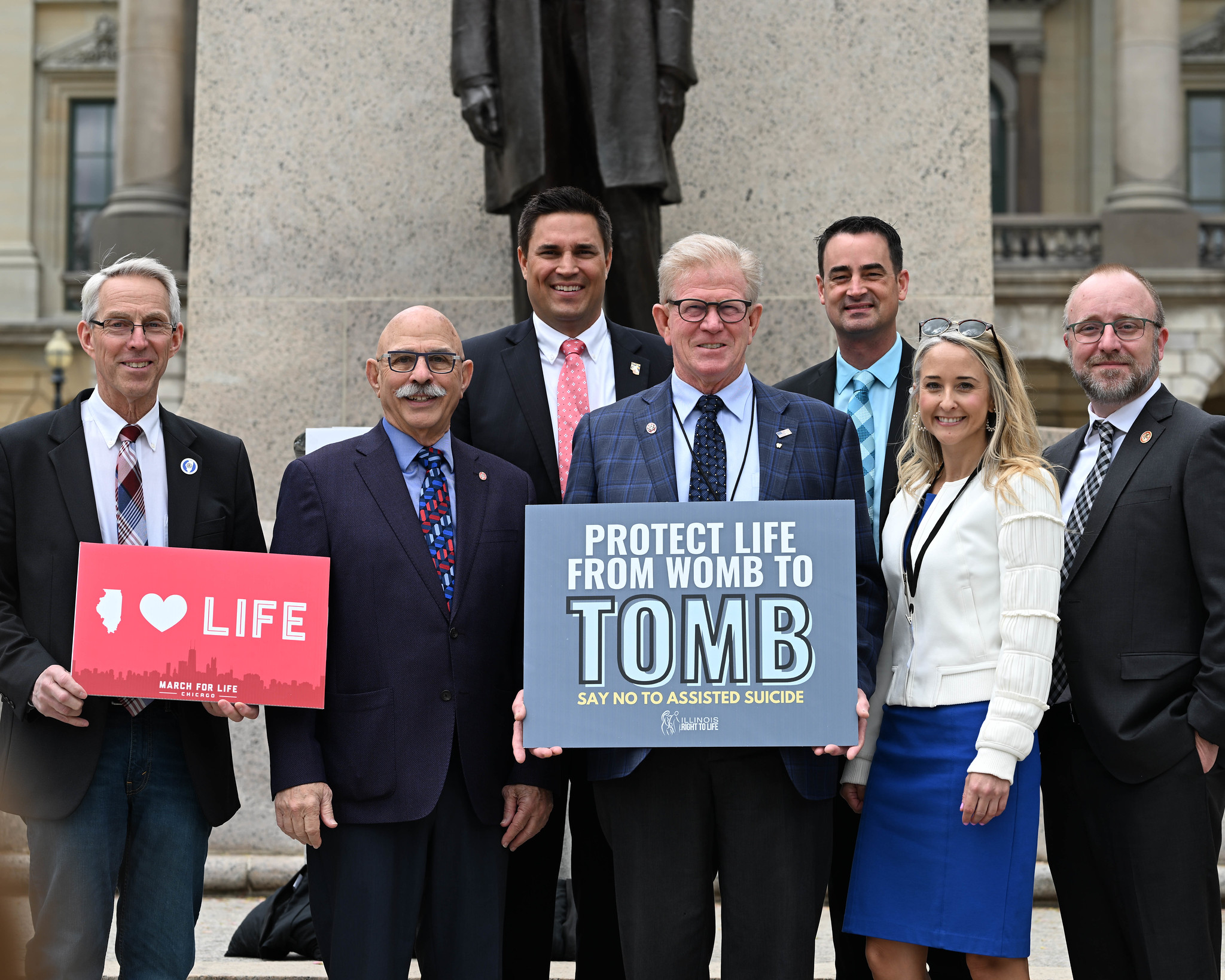

Rep. Halbrook today joined Illinoisans from across the state who traveled to the Capitol to show their support for Right to Life policies. “It was wonderful to see so many…

Videos

Latest Video